net investment income tax 2021 trusts

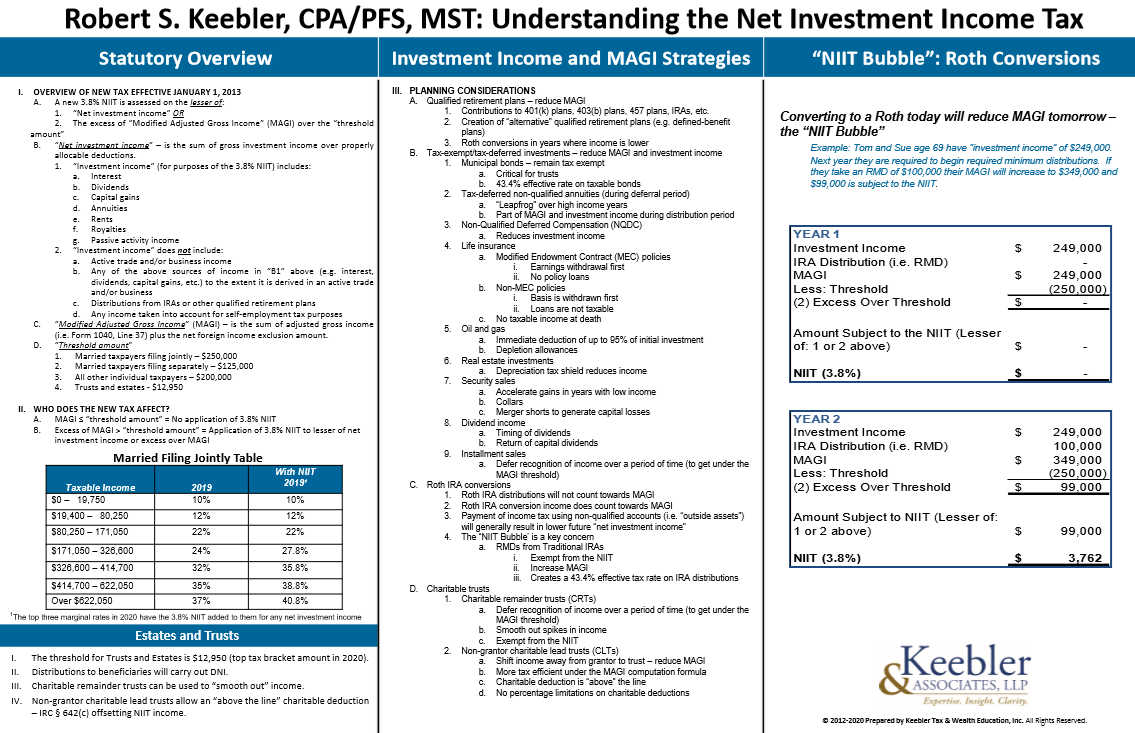

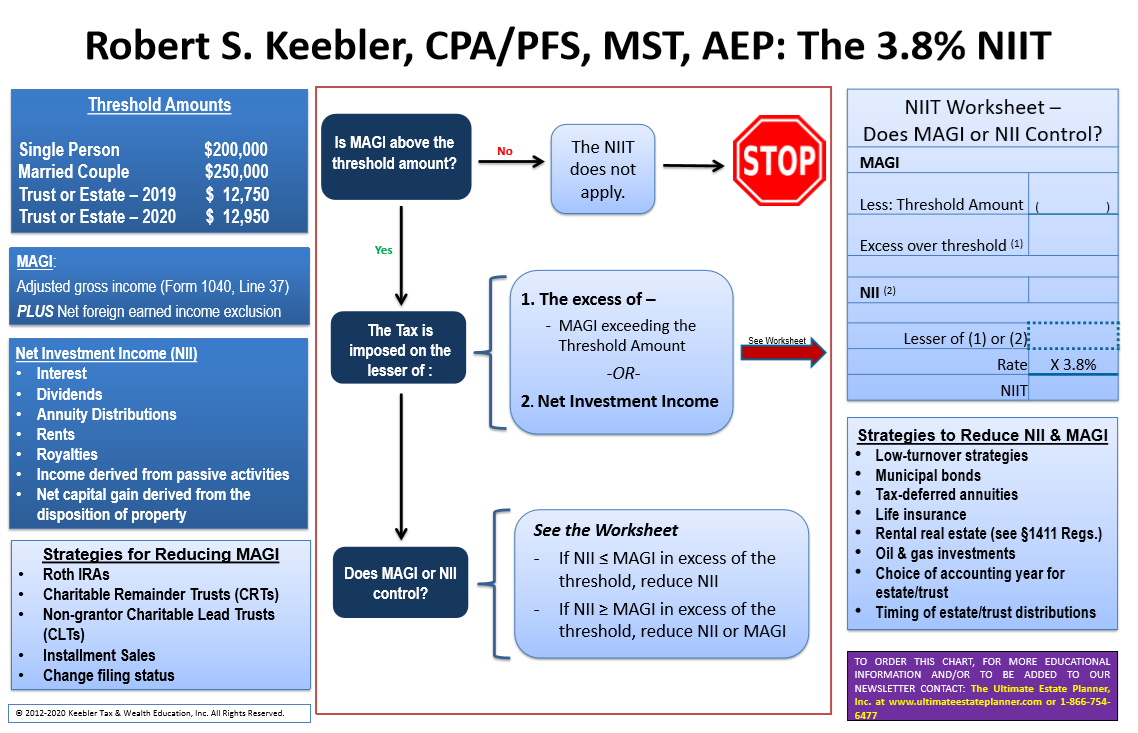

The net investment income tax applies to estates and trusts when they have net investment income and have adjusted gross incomes for the year exceed the dollar amount at which the highest tax bracket begins. Wisconsin has a state income tax that ranges between 4 and 765 which is administered by the Wisconsin Department of Revenue.

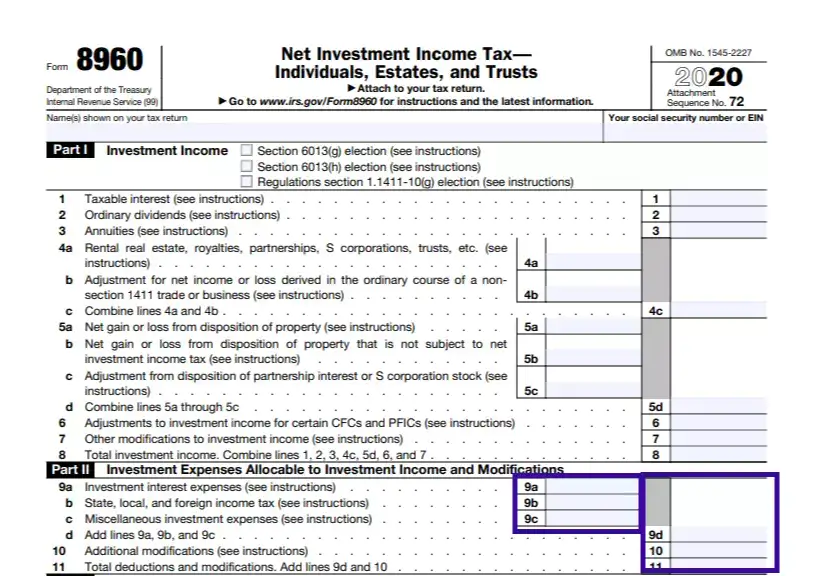

Irs Form 8960 Fill Out Printable Pdf Forms Online

Also to note that the Schedule K-1 should be properly filled if the trust has transferred an asset to a beneficiary and claimed a deduction for that.

. The following information will help you with completing your tax return for 2021. Possession on income also taxed by California trusts only Pass-Through Entity Elective Tax FTB 3804-CR. 16 Deferred non-commercial business losses 2021.

In general net investment income for purpose of this tax includes but isnt limited to. The individual tax. IT5 Net financial investment loss 2021.

17 Net farm management deposits or repayments 2021. IT4 Target foreign income 2021. Net investment income NII is income received from investment assets before taxes such as bonds stocks mutual funds loans and other investments less related expenses.

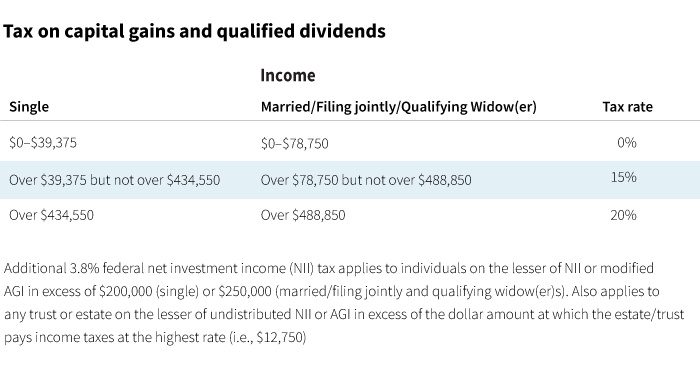

14 Personal services income PSI 2021. Those who are over 60-years-old with up to Rs 3 lakh net income the tax rate is nil. The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other.

The 2021 rates and brackets were announced by the IRS here What is the form for filing estate tax return. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. Schedule E Investment Income of an RTC Section 23701g 23701i or 23701n Organization.

2021 Tax Rate Schedule for Trusts. 14 Personal services income PSI 2021. COVID-19 the American Rescue Plan Act of 2021.

13 Partnerships and trusts 2021. TaxFormFinder provides printable PDF copies of 96 current Minnesota income tax forms. The Income Tax Return for Estates and Trusts.

Net income tax paid to another state or a US. 15 Net income or loss from business 2021. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022.

The federal estate tax return has to be filed in the IRS Form 1041 the US. Income Tax Return for Estates and Trusts. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file.

Estates and trusts that generate income during the year are subject to tax rates set by the federal government. Two big changes in 2020 were self employed people were able to. And for very senior citizens who are over 80-years-old up to Rs 5 lakh net income the tax rate is nil.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. The tax brackets are adjusted each year for inflation just as personal income tax brackets are. TaxFormFinder provides printable PDF copies of 89 current Wisconsin income tax forms.

13 Partnerships and trusts 2021. Income Tax Return for Estates and Trusts. 18 Capital gains.

Adjusted taxable income ATI for you and your dependants 2021. Theyre required to file IRS Form 1041 the US. Minnesota has a state income tax that ranges between 535 and 985 which is administered by the Minnesota Department of Revenue.

These instructions are in the same order as the questions on the Tax return for individuals 2021. Due to the coronavirus crisis and changes in the US federal tax code from the recently passed American Rescue Plan Act of 2021 the tax filing date for individuals to pay their 2020 income taxes was moved by the IRS from April 15 2021 to May 172021. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year.

Taxpayers use this form to figure the amount of their net investment income tax NIIT. If the submission of tax savings investment or similar documentation is delayed TDS may be deducted by the employer till the required documents have. Created as part of the Health Care and Education Reconciliation Act to fund healthcare reform in 2010 the net investment income tax NIIT is a 38 surtax that typically applies only to high.

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

What Is The Net Investment Income Tax Caras Shulman

What Is The The Net Investment Income Tax Niit Forbes Advisor

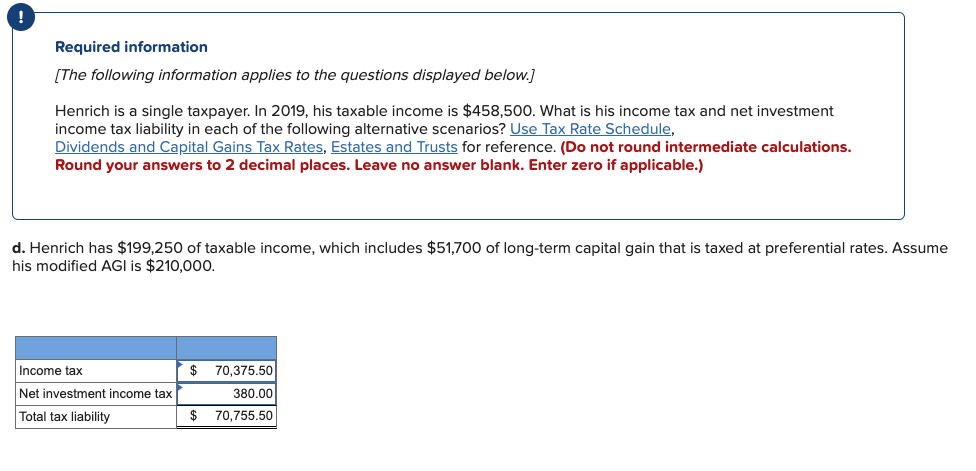

Solved Required Information The Following Information Chegg Com

3 8 Net Investment Income Tax Td T

What Is The 3 8 Net Investment Income Tax Niit Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Net Investment Income Tax For 1040 Filers Perkins Co

Net Investment Income Tax Niit Quick Guides Asena Advisors

Client Friendly Charts Handouts Archives Ultimate Estate Planner

What Is The 3 8 Medicare Tax Or Net Investment Income Tax Niit Legal 1031

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

How To Calculate The Net Investment Income Properly

Gauge Your Tax Bracket To Drive Tax Planning At Year End

What Is Net Investment Income Tax Overview Of The 3 8 Tax

Aca Tax Law Changes For Higher Income Taxpayers Taxact

How To Complete Irs Form 8960 Net Investment Income Tax Of 3 8 Youtube

How To Calculate The Net Investment Income Properly

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef